Retirement Revision Analysis Boise, ID

WEALTH MANAGEMENT

Boise, ID Retirement Planning Services

Understanding when to retire can often feel like a daunting task, and we're here to help you navigate it. Remember, retirement isn't about hitting a certain age, it's about reaching a stage in life where you feel ready. Our goal is to support you in retiring on your terms. This involves crafting a retirement plan that aligns with your future aspirations and financial stability. We're committed to helping you get there, making your transition into retirement as seamless and fulfilling as possible.

Retirement Cash Flow

What is your income going to look like during retirement? Will you have a pension or be supported by your retirement savings? Will you have to take RMDs, and how will they affect your taxes? Will your cash flows during retirement be sufficient to cover your living expenses for the rest of your life? Our Retirement Revision Analysis will project all of your different sources of income and expenses so you can answer all of these questions and retire with confidence.

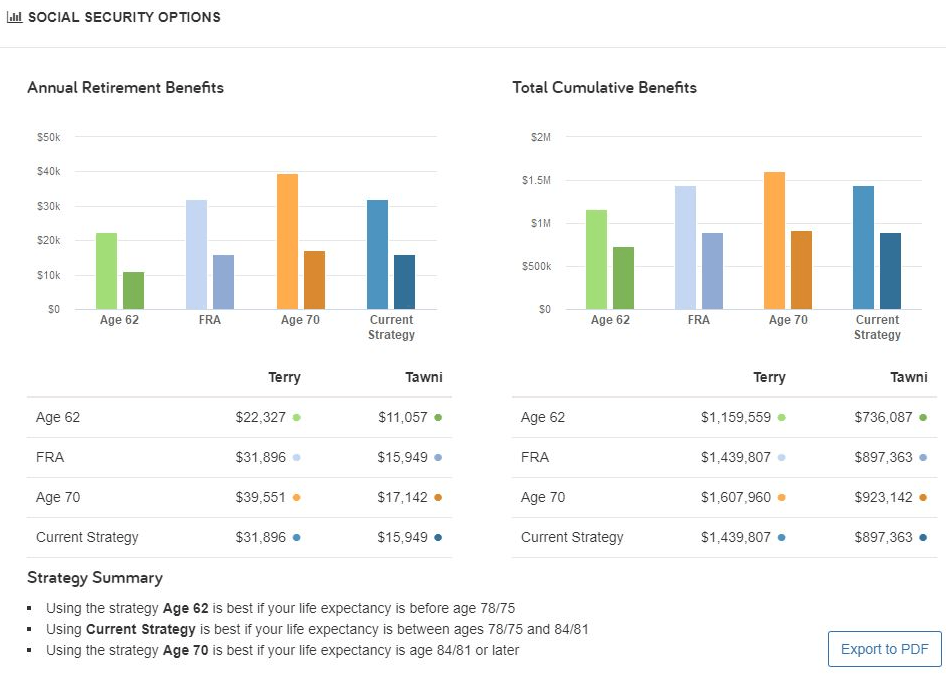

Social Security Projections

You have worked incredibly hard during your career and earned your social security benefit, and we want to make sure you get the most out of it. We can show you how taking your social security at different ages affects your cash flows during retirement. That way, you can confidently decide when collecting your social security is suitable for your retirement.