Education Planning Boise, ID

WEALTH MANAGEMENT

Boise, ID Education Planning Services

Whether you're preparing for your child's imminent college journey or establishing an education fund for the years to come, our team is here to support you. The landscape of education funding is vast and can often be complex to navigate, with a myriad of options available. However, finding the one that best fits your unique circumstances doesn't have to be a daunting task. Leveraging our extensive experience and comprehensive tools, we are committed to helping you identify the most suitable funding solutions for your family's educational needs. Your child's future is our priority.

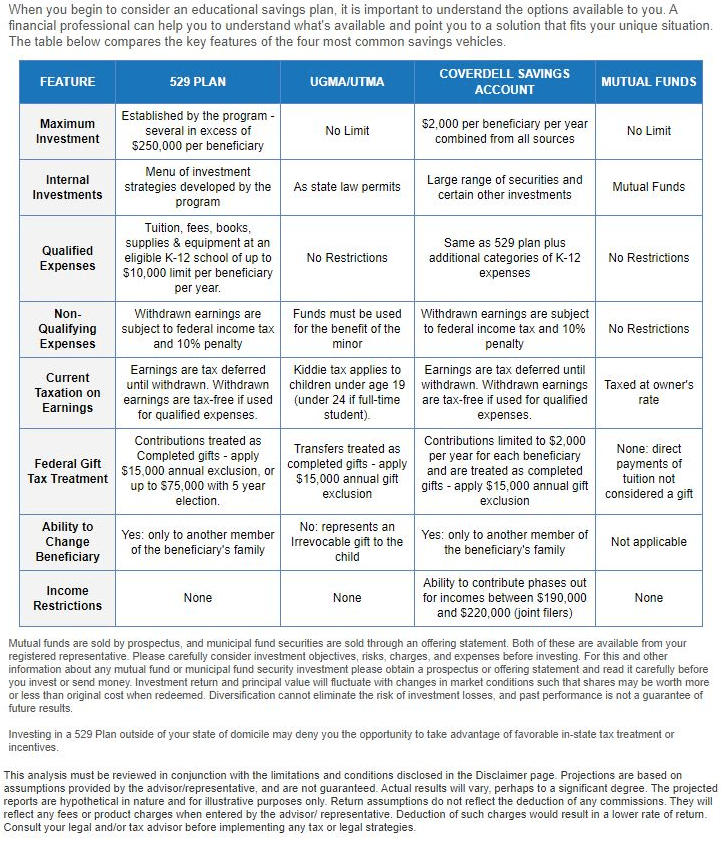

The Right Saving Plan

Our financial advisors have the tools and experience to help you choose the college savings vehicle that fits your lifestyle. The type of plan you choose determines what the savings can be spent on, whether or not there is a tax benefit for saving for college, and how they affect student’s financial aid.

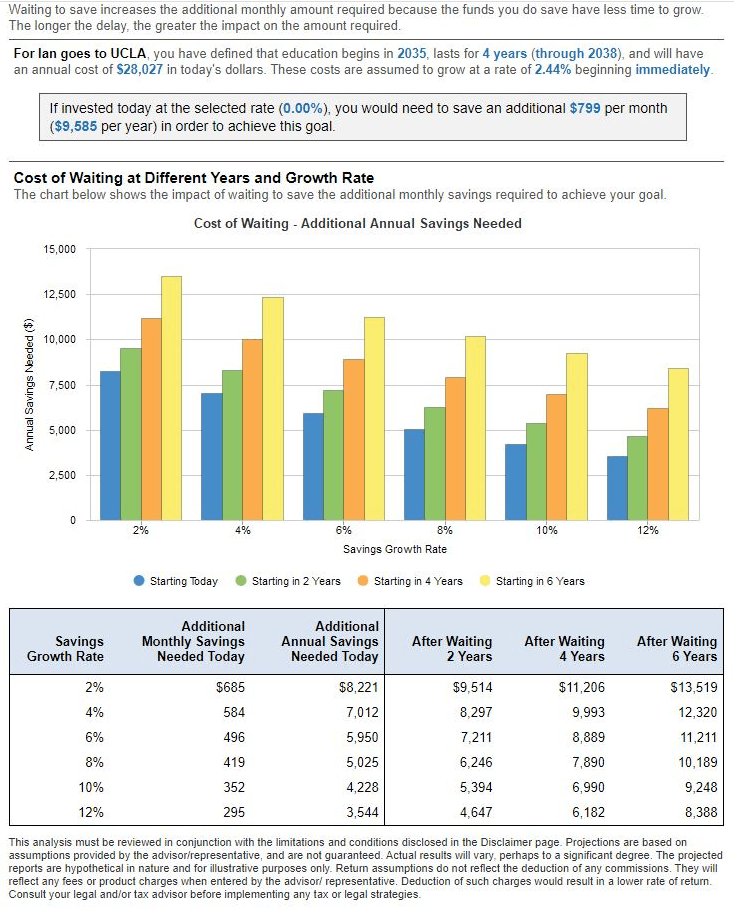

Cost Of Waiting

The cost of education has been growing for decades, and we want you to understand how waiting to save for college affects your education funding goals. We have access to the cost of education at universities across the country, so you can see how much private school versus public school or in-state versus out-of-state tuition affects the price of a college education.

Options For Meeting Education Plan

Our team will help you develop a savings plan for your education funding goals. We can help you determine how much you need to save on a monthly or annual basis. Or how much you can set aside now to meet your goal in the future.

Financial

Planning

Retirement

Planning

Investment

Management

Risk

Management

Estate

Planning

Employee Stock

Ownership Planning

Education

Planning

Cash Flow

& Budgeting

Contact Us:

Sacramento Office:

1783 Tribute Road

Suite D.

Sacramento, CA 95815

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Call

Boise Office:

Boise, ID

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Call

All Rights Reserved | Twin Rivers Wealth Management

Advisory services offered through Twin Rivers Wealth Management, a Registered Investment Advisor.