Estate Planning Boise, ID

WEALTH MANAGEMENT

Boise, ID Estate Planning Services

An estate plan serves as your final testament, a way to ensure that the legacy you leave behind aligns with your values and aspirations. It's your opportunity to express your last wishes in a clear, written format, guaranteeing the welfare of your loved ones when you're no longer here. We've witnessed first-hand how well-crafted estate plans can foster unity among families and provide clarity, enabling them to honor and celebrate your life appropriately. Conversely, lack of estate planning can lead to confusion and discord, potentially overshadowing a lifetime's worth of accomplishments. Our team is committed to assisting you in thoughtfully designing your estate plan, allowing those closest to you to honor your legacy and respect your final wishes.

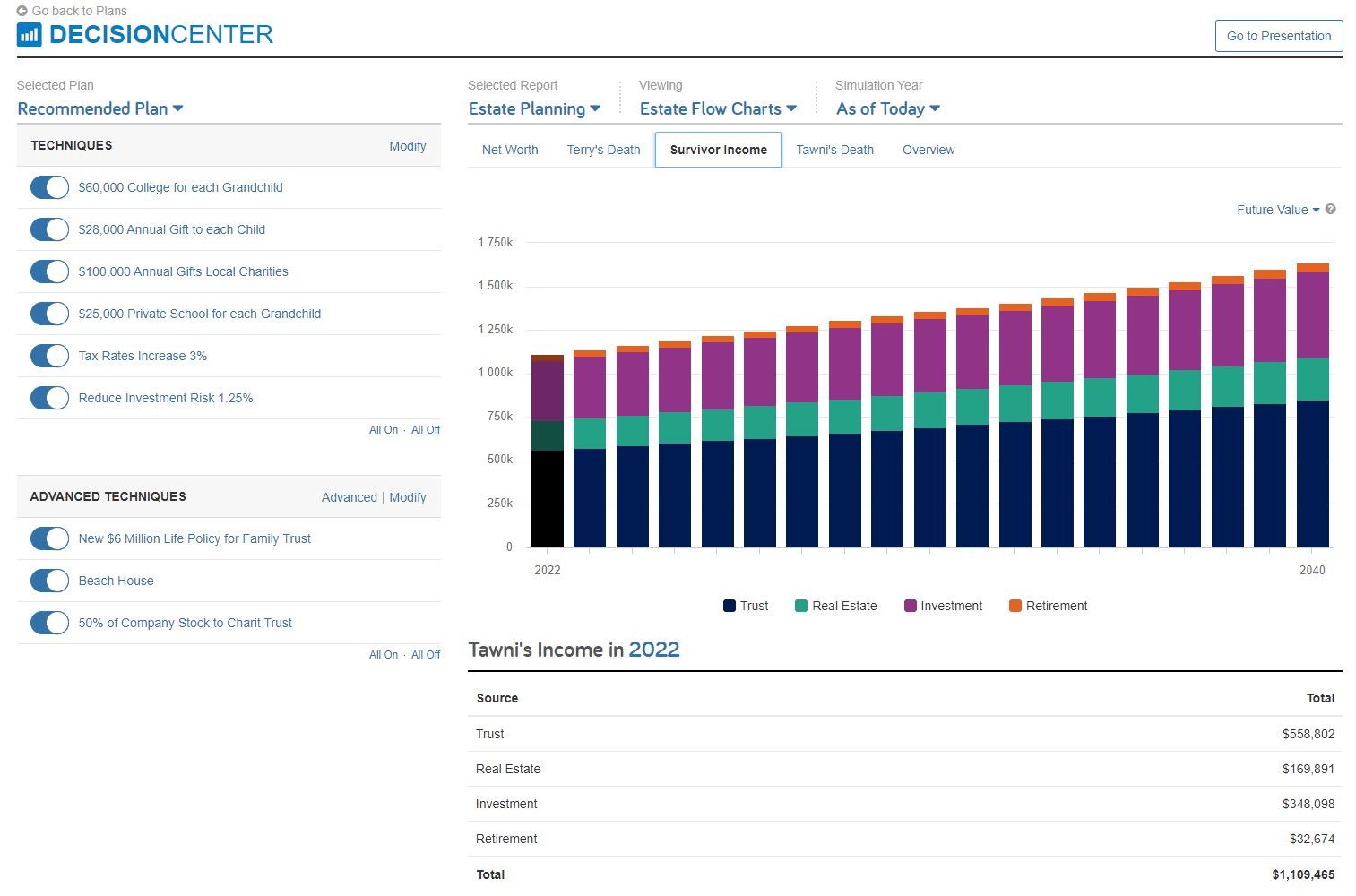

We can also demonstrate the difference between having a trust & will and leaving things up to the court to decide who receives your assets. If the courts have to get involved, there are heavy costs engaged through what is known as probate.

- 4% fee of the first $100,000 of your assets

- 3% fee for the next $100,000

- 2% fee on the next $800,000

- 1% on the next $9,000,000

- 0.5% on the next $15,000,000

- Fees for both the court, attorney, and executor of the estate

If not all of these fees, most of these fees can be avoided by developing a proper estate plan with the right people named as your trustees. Our team is ready to help you design your estate plan and accompany you to your meeting with an estate planning attorney to draft the documents needed to avoid the costly probate process. We want to be a second set of eyes and ears in your estate planning meetings so your family has someone they can rely on to make sure they follow your final wishes. Designing an estate plan is emotional and sometimes difficult to discuss. We have the experience and tools to guide you through the delicate process of creating your legacy and your estate plan.