Twin Rivers Client Tools

There is nothing worse than feeling unprepared during times of uncertainty. Whether you lack information or tools, decisions become emotional, and mistakes can happen. We want our clients to understand how to use the tools they have available to access information on their finances 24/7.

AdvisorClient.com

All clients have access to TD Ameritrade’s client platform called advisorclient.com. To access the account, you go to www.advisorclient.com and enter your credentials. If you have never established a profile with TD Ameritrade, click on Set up my profile and follow the prompt from there. After establishing an account, you can find your current investment allocation, statements, tax forms, and update your contact information with TD Ameritrade. If you have any issues establishing your TD Ameritrade account, contact your advisor, and they will be happy to assist you.

Twin Rivers Portal

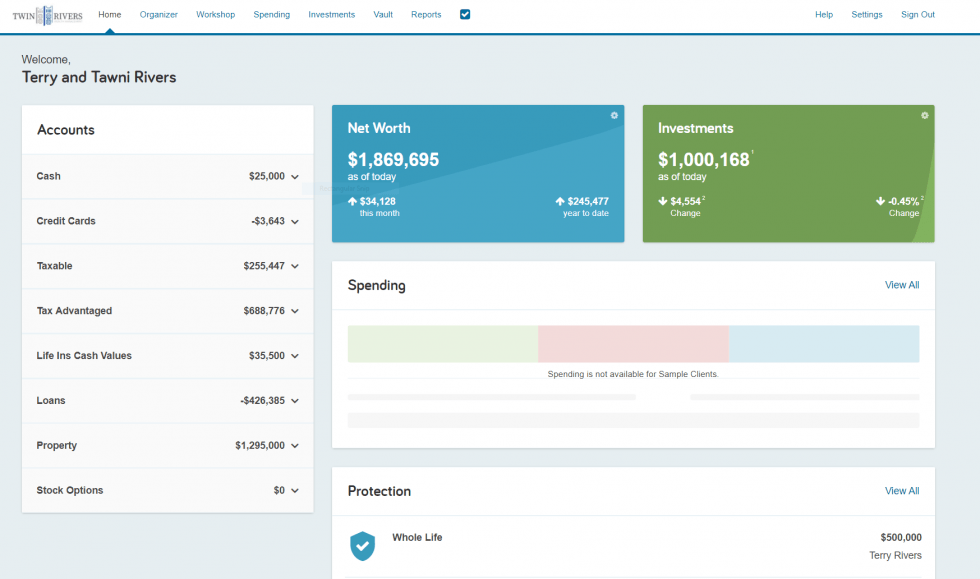

For our wealth management clients, we provide the Twin Rivers Portal . Here you can connect all of your accounts with different financial institutions to your portal to have a complete picture of your financial life. The tools we find most useful to clients are the spending, investments, vault, and report applications.

The spending tab should look familiar to you if you have been through a living expenses analysis with your advisor. Here, you can track and categorize your spending and set budgets for yourself. Through the investments tab, you can look at your entire financial portfolio’s asset allocation or the asset allocation of each account. For our clients that like the details, you can get even more specific and download a morningstar report on each of your investment holdings. The vault is an encrypted cloud space, where you can store documents privately for your eyes only. You can also use the vault to share documents securely with your advisor that have sensitive information. The reports tab is where you can generate numerous reports, from a balance sheet to a cash flow report.

We want you to feel like you are in control of your financial life during times of uncertainty. The tools you have available provide you access to information on your financial life at any time. If you have any issues accessing or using advisorclient.com or your Twin Rivers Portal, please do not hesitate to contact your advisor.

Can We Help?

The Twin Rivers team wants to guide you on your journey to financial success. If you have any questions about the topics above or would like to discuss any financial decision you are facing, please do not hesitate to contact our team.

Contact Us:

Sacramento Office:

1783 Tribute Road

Suite D.

Sacramento, CA 95815

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Call

Boise Office:

Boise, ID

Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Call

All Rights Reserved | Twin Rivers Wealth Management

Advisory services offered through Twin Rivers Wealth Management, a Registered Investment Advisor.