Social Security – When is the right time

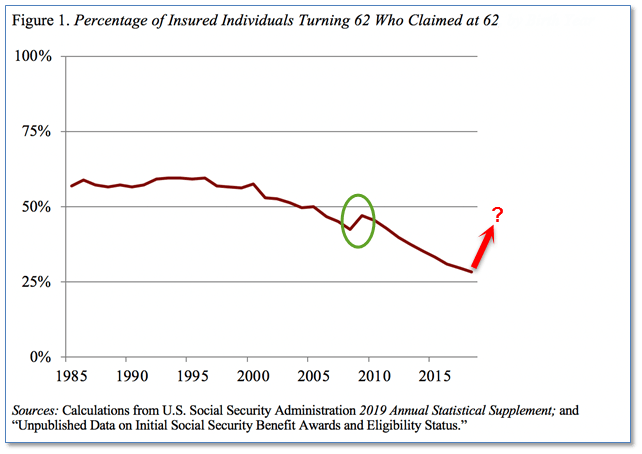

For many years, financial advisors have been encouraging pre-retirees to wait as long after age 62 as possible before claiming Social Security benefits, in order to maximize the benefits and extend the wage-earning years. Beginning about the year 2000, a steady decline in the percent of 62-year-olds claiming social security benefits began and has since dropped by about half, from the 60% range to the 30% range. During the Great Recession, though, the percentage of 62-year-olds claiming Social Security spiked from 42.2% in 2007 to 46.9% in 2009 before again dropping back to the downtrend. But, at Twin Rivers, we consider what is best for our client’s lifestyle, and that means looking at social security from a different perspective.

We believe the most important piece of our client’s financial plan is the relationship we have with our clients. We have to know what you care about most, and what you want your life to look like during retirement before we can demonstrate when you should take social security. And, so should any other financial advisor. What if you plan to work part-time during retirement, or turn your hobby into a stream of income? Or, what if you need the money so you can relax in your early years of retirement? Every year you delay taking social security after your full retirement age, you an 8% increase in your social security benefit. But, if you wait until the maximum age of 70 for that increased benefit, you do not recoup the money you gave up until you turn age 83. These are just some of the factors to consider when taking social security.

Initiating your social security benefit at the wrong time can cause both negative lifestyle and financial implications. At Twin Rivers, we take the time to make sure you understand all your options when it comes to your social security benefit. In fact, for our wealth management clients, we go to the social security office together to ensure they get all their questions answered before making such an important decision. If you are considering retirement, and when you should collect social security, please do not hesitate to contact our team. We have the tools and experience to build you a social security analysis so you can have the clarity needed to decide when taking social security is best for your life.

Can We Help?

The Twin Rivers team wants to guide you on your journey to financial success. If you have any questions about the topics above or would like to discuss any financial decision you are facing, please do not hesitate to contact our team.