Recapture of Depreciation

“Buy land, they ain’t making any more of it.”

is a statement that has been reused time and time again in the real estate industry since the infamous Mark Twain said it. Or, was it Will Rogers? Regardless of who said it, both men were successful in business and masters of their craft. They both shared the belief that there was only one thing you can invest in that humankind is not making any more of, and that is God’s green earth. I would love to see their faces now if they saw the Palm Islands off the coast of the United Arab Emirates. Or the new sports complexes where a little extra coastline was needed for the stadiums to fit. Historically speaking, though, the sentiment has rung true.

Investments in land or properties have risen in value at a slow, yet consistent pace for the past 100 years. Be aware, though, if you owned a home in 2008, you understand how quickly your home’s value can drop. And, if you own the same house now that you did in 2008, you have probably hopped online to find the estimated value of your home. Hopefully, you discovered that your home is as valuable now as it was before the great recession. Here is a fun fact about selling your primary residence: Per the IRS Code, you can exclude from your income up to $250,000 in capital gains ($500,000 married). That is, of course, if you can pass an ownership/use test along with a frequency test. That means most people can sell their primary residence tax-free! But what about your rental property?

Rental properties can make a fantastic investment, but there are many factors to take into consideration before you make such a serious commitment. Some of these factors include: keeping your property occupied, being prepared for legal liability as to what happens on your property, understanding the rental laws for your state, and maintaining proper management/accounting records.

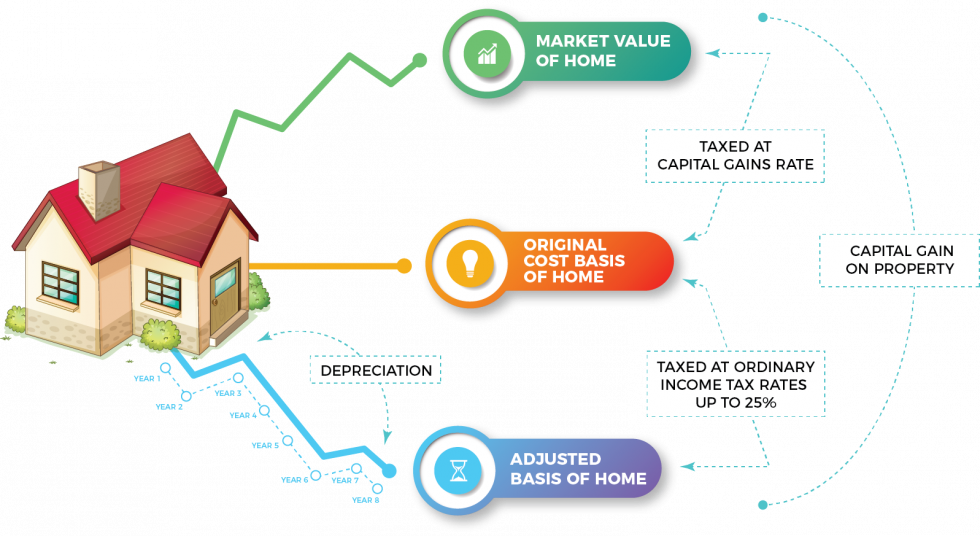

If you have talked to a real estate professional, you have probably heard of getting between a 5% and 7% return on investment. What we mean by proper accounting is factoring in the depreciation taken against the value of your property during the time the rental was in service. We want you to know how much of a return you are getting for the dollars you paid into the property. That means including the recapture of depreciation tax that takes place when you sell an investment property. But why does that matter?

When you sell your rental property, you must pay back some of the depreciation taken against your rental income over the time the property was in service. Therefore, rental properties are commonly referred to in the tax industry as a “tax bomb.” We have seen rental property owners get blindsided by the tax liability caused by selling a long-time owned rental property. The return on an investment property turns out to be quite different than estimated if you factor in the recapture of depreciation.

This depreciation factor is something you can calculate before you purchase a rental property or convert your potentially tax-free primary residence into a rental. We believe owning a rental property can be an excellent alternative to the equities market in your financial portfolio. We just want you to be sure it is the right investment for your life. So, before you make an essential investment with your hard-earned savings, please contact our team. We would love to provide you an analysis and show you how the choice you are about to make will truly affect your lifestyle in the future. That way, you can make a confident decision going forward.

Can We Help?

The Twin Rivers team wants to guide you on your journey to financial success. If you have any questions about the topics above or would like to discuss any financial decision you are facing, please do not hesitate to contact our team.