General Obligation Bonds

The propositions we vote on commonly refer to the issuance of general obligation bonds. This week we want to review “GO” bonds and how they affect your overall portfolio. General obligation bonds are a type of municipal bond, which pays interest rates to their investors at favorable tax rates. Let’s take a look at these bonds from the perspective of a voter and an investor.

Voting on Proposition Funded by General Obligation Bonds

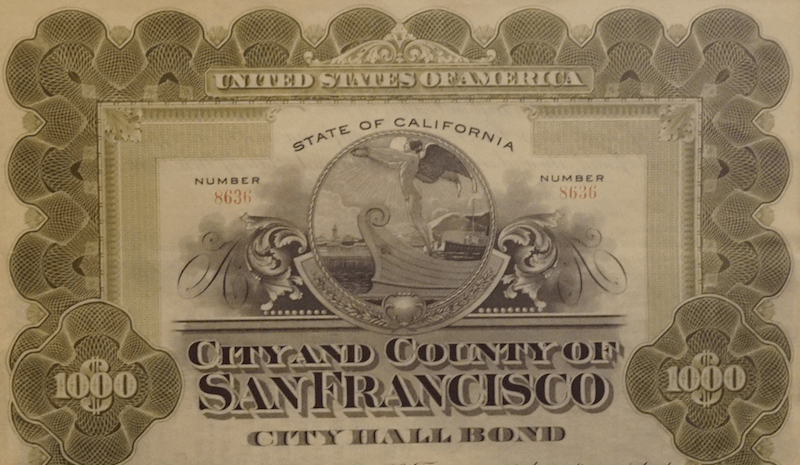

Bonds are loans from the people, to the government, to fund projects. Like any loan, principal and interest are paid back over a certain period. When a proposition makes the ballot, sometimes they are supported by state and local government-issued bonds. State and local issued general obligation bonds are backed by the taxing power of the governments selling them. Meaning, the state repays the principal and interest of the bonds from the state’s general fund. The state’s general fund is where taxpayer dollars flow before being distributed.

For example, proposition 14 requests $5.5 billion in general obligation bonds to fund STEM cell-related projects. The funds from the sale of the bonds to the public will fund STEM-related research and medical projects. The state’s general fund will repay the loans at an estimated rate of $230 million per year for the next 30 years, dependent on interest rates offered.

Investing in Municipal General Obligation Bonds

As an investment, interest paid by municipal bonds receives favorable tax treatment. The federal government does not tax the interest paid by municipal bonds, and if you purchase municipal bonds from your state of residence, the interest is not taxed at the state level either. The promise to repay the loan is what establishes the security of the bond. From an investor’s perspective, general obligation bonds are rated based on the state or local government’s creditworthiness issuing them. That municipal’s ability to collect taxes and maintain its general fund is directly related to a municipal bond’s credit rating. Think of a city-backed general obligation bond versus a state-backed general obligation bond.

It is not unheard of for cities to go bankrupt. Forty minutes to the west of Sacramento is Vallejo, the first city to go bankrupt in California. And, more recently, in 2012, the city of Stockton filed for bankruptcy. On the other hand, California has proven it has no problem raising taxes to fund government projects, and the state-funded bonds backing these projects reflect that type of confidence.

Understanding general obligation bonds are essential as a voter and an investor. We want to ensure our clients understand the investments they hold in their portfolio, and general obligation bonds are just one type of investment that receives favorable tax treatment. If you have any questions about our investment strategy, or if municipal bonds should play a role in your portfolio, please do not hesitate to contact your advisor.

Can We Help?

The Twin Rivers team wants to guide you on your journey to financial success. If you have any questions about the topics above or would like to discuss any financial decision you are facing, please do not hesitate to contact our team.